6/6 - Weekly Movements (STI and REITs)

I'm starting a new weekly series, where I will give an overview/snapshot of how certain sectors have shifted week to week. For a start, I will be looking at STI components, and S-REITs. If you have other companies to suggest, drop me an email.

S-REITs

The y-axis and x-axis shows how much the volume and price changed from last week to this week. The weekly price is determined by averaging open, close, low and high prices, then weighting it by volume across the days in the week. Using VWAP would be ideal, but I can't find a free source for that. The current method would be pretty indicative of general sentiment too, for most cases.

In general, REITs saw a week-on-week price appreciation, while volume changes were mixed between different REITs.

Sector Level:

Dasin Retail Trust was the outlier amongst Retail REITs, seeing a 300+% increase in volume compared to the past week.

Commercial REITs had a few outliers in volume (Elite and OUE REIT) as well as price (Ascendas India Tr).

Hospitality REITs like CDL and ARA saw the biggest increases in week-on-week price, while the others saw more modest appreciations.

Industrial and Logistics REITs recorded slight weekly price gains, and stagnant volume week-on-week.ParkwayLife, a Healthcare REIT, saw a doubling in volume week-on-week.

Ranking:

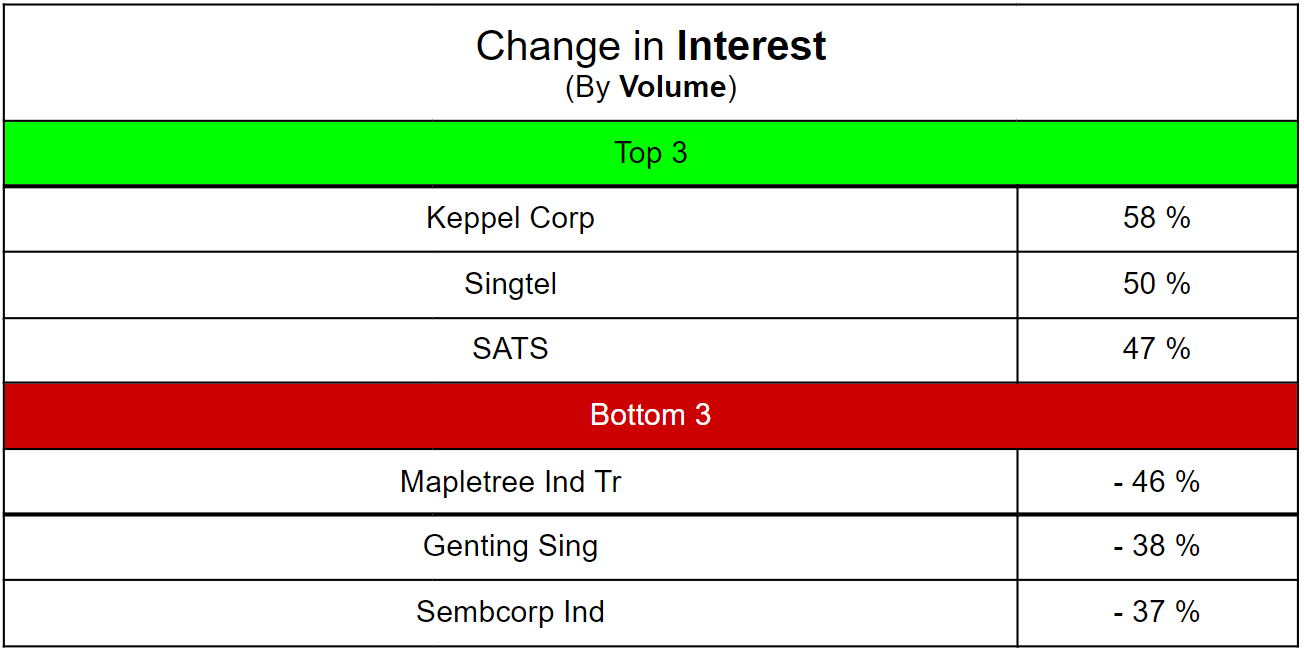

This table shows the top 3 gains and drops in week-on-week volume, which can be considered as a proxy for general investor interest.

Apart from the above indicator for general interest, the below table looks as weekly price changes, which can be considered as a proxy for which counters investors find more favorable/attractive this week.

STI Components

For the STI components, there is no clear trend in week-on-week volume or price changes.

Most price differences were roughly within the 1% margin, with the outliers within a 3% range.

Volume was mixed as well, with most counters within the 10% margin, with outliers within 60% differences.

Ranking:

__________________________

All data sourced from Yahoo Finance. REIT's classification into primary sectors sourced from REIT-tirement. New posts for this series will come up either late Friday (after market hours), or over the weekends.

Suggestions welcome. Also, if you find my content interesting, consider subscribing either through Facebook or through the email subscribing widget on the sidebar (below for mobile users).

Cheers,

InvestingNugget

![[Guest Post] Why Jewelry Is a Good Gift but a Poor Investment](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg-Rbw8vVpVw4RuUyuSPDuCk42NPO56tNVDd6GX_ha29_nzX9zf79yzoP2A-vXjhStOqF_d6_aD6L7jMo0eVzUm2aneKroCyOsUlqj_biAUGYailSVUigzMjYBDaqyqVfA-sQLqnOpui7w/s72-c/)